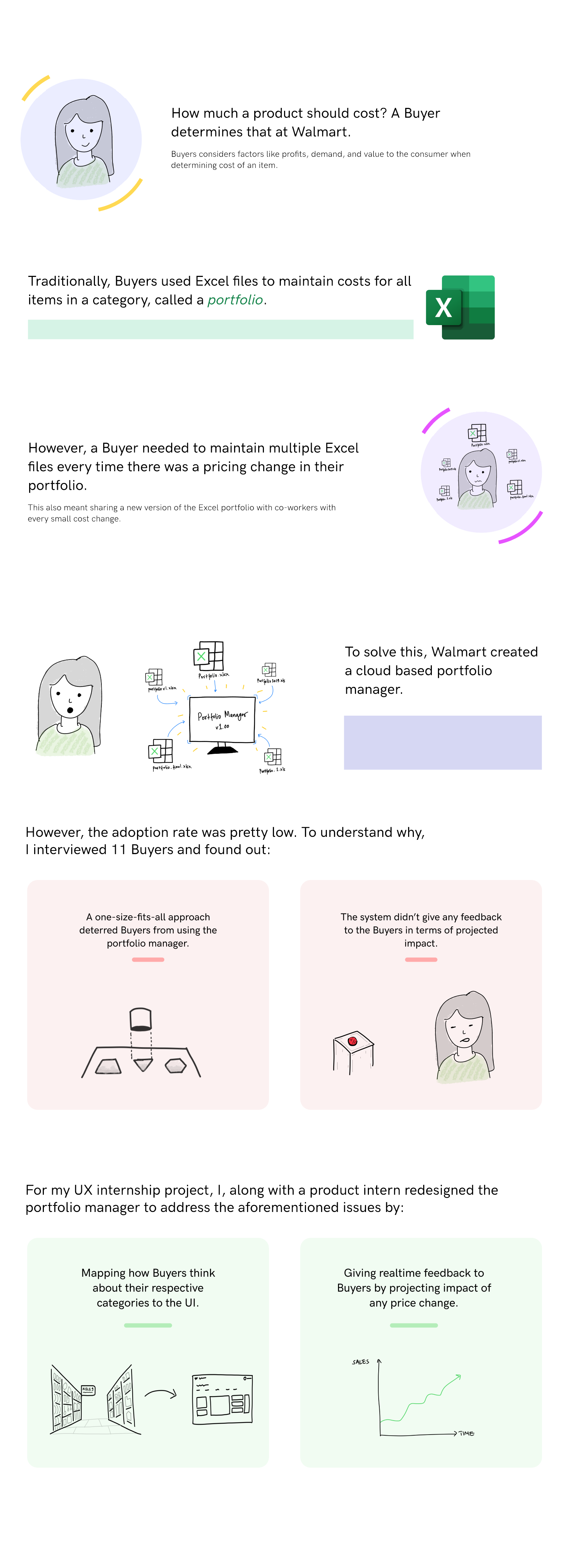

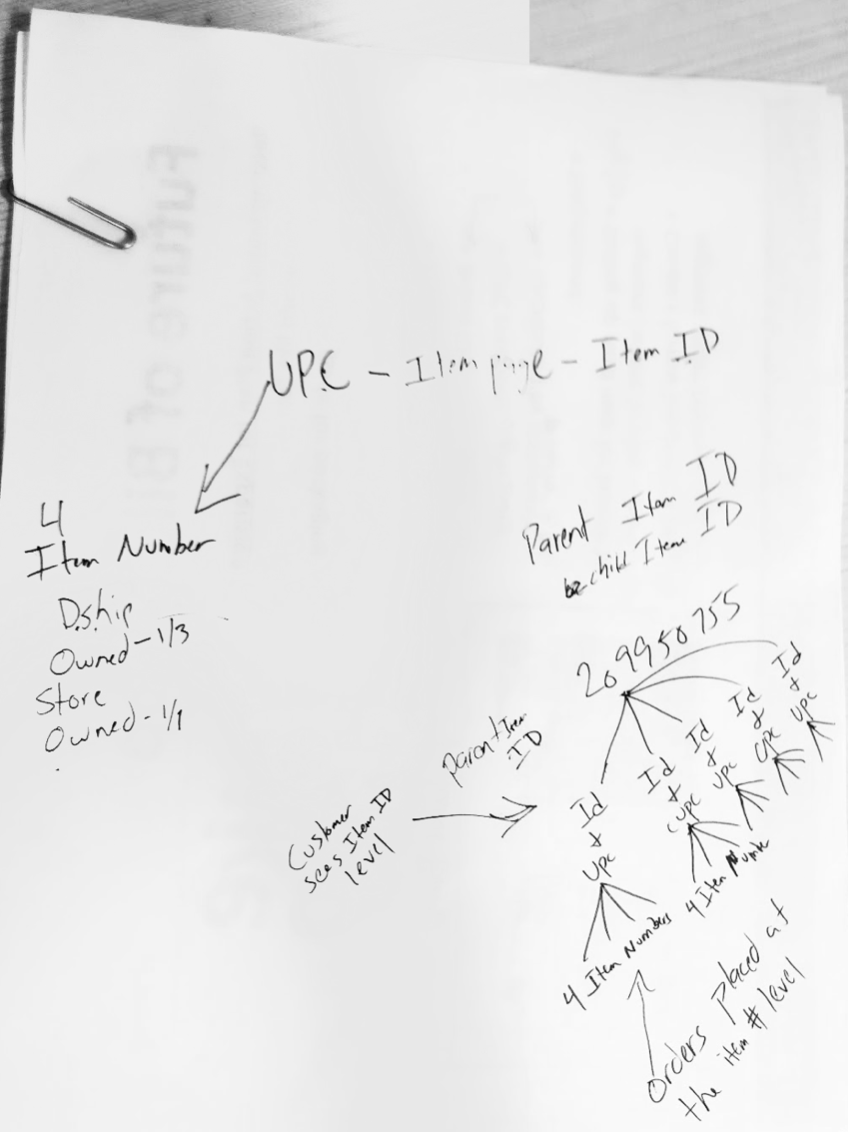

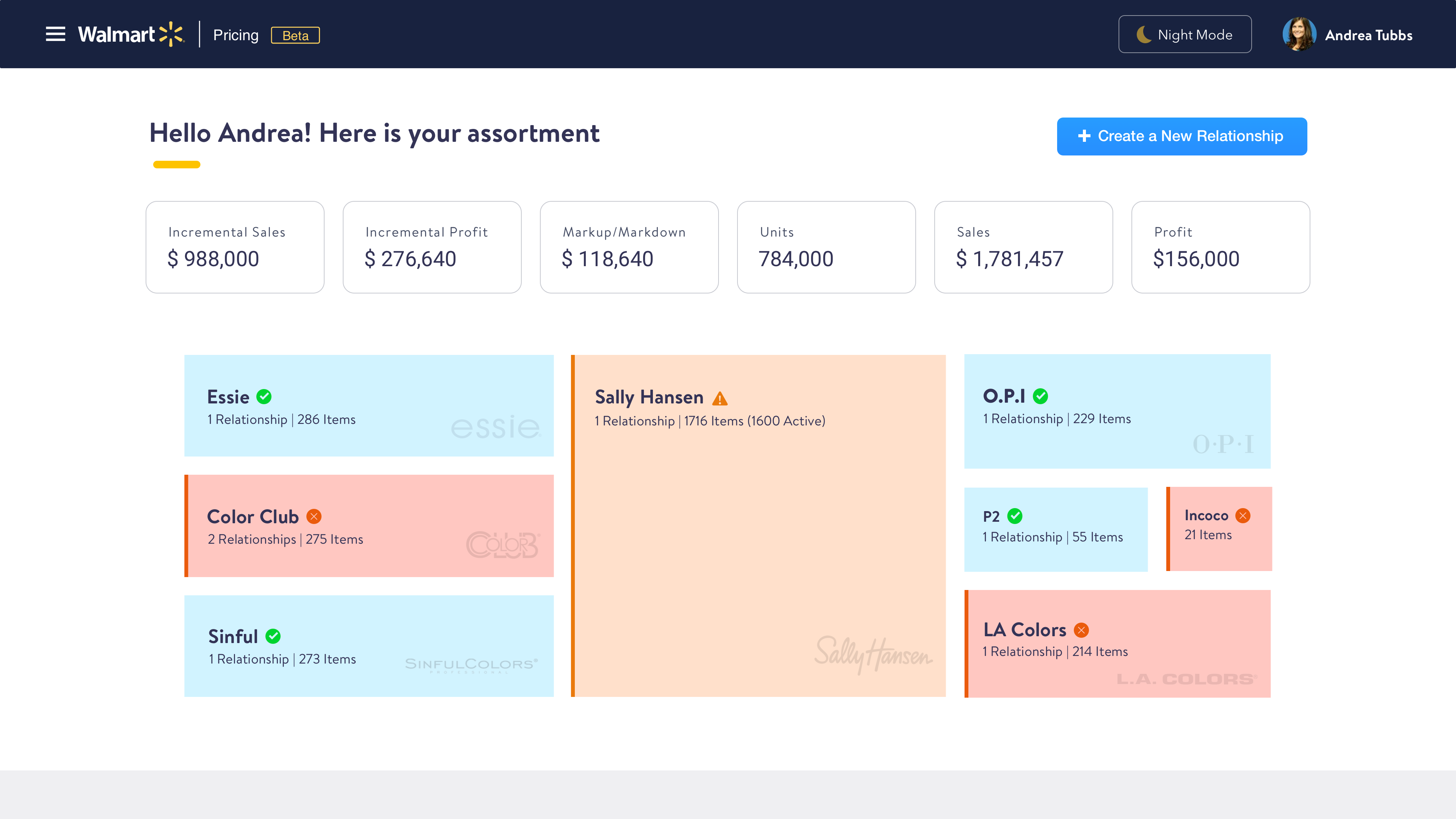

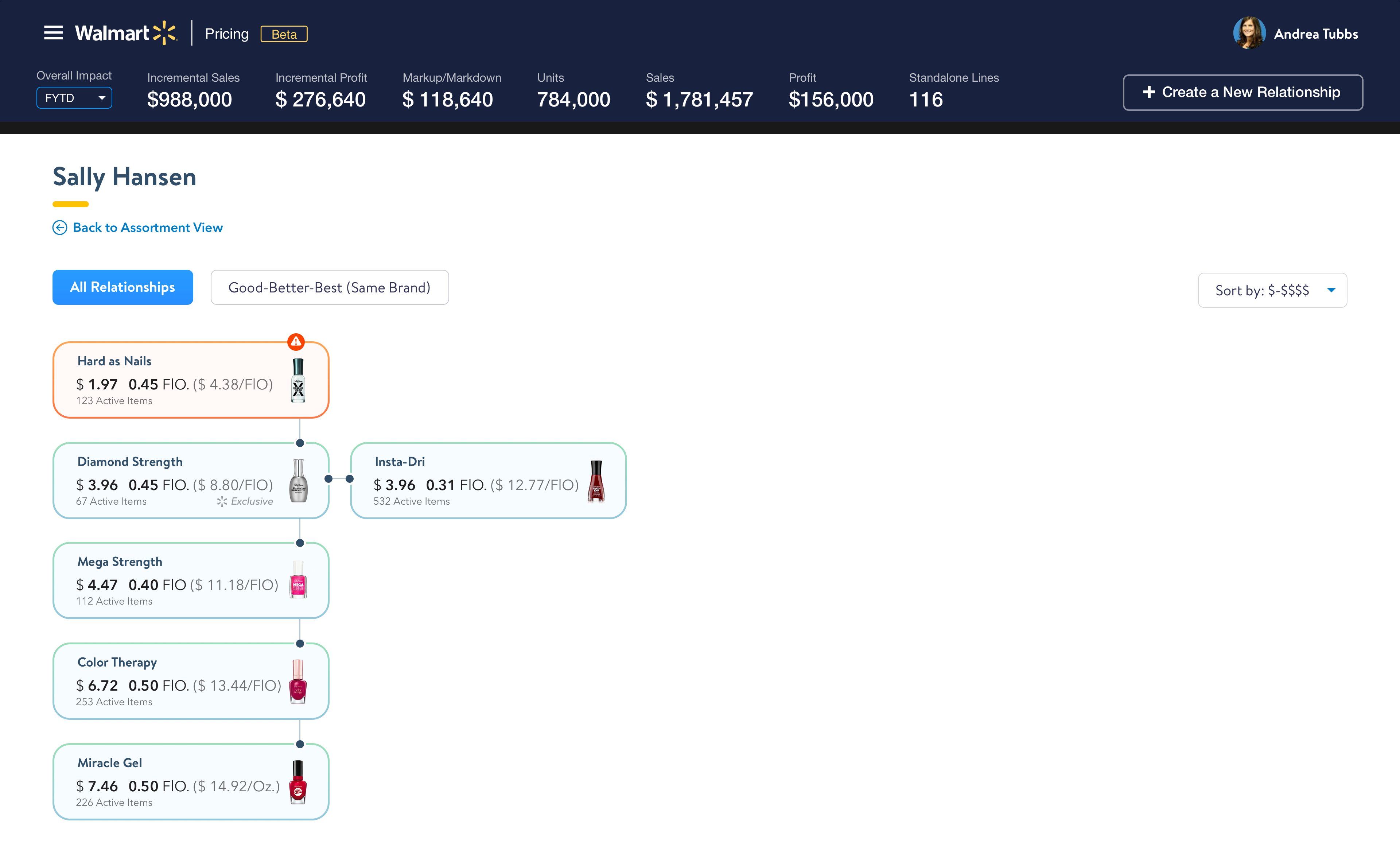

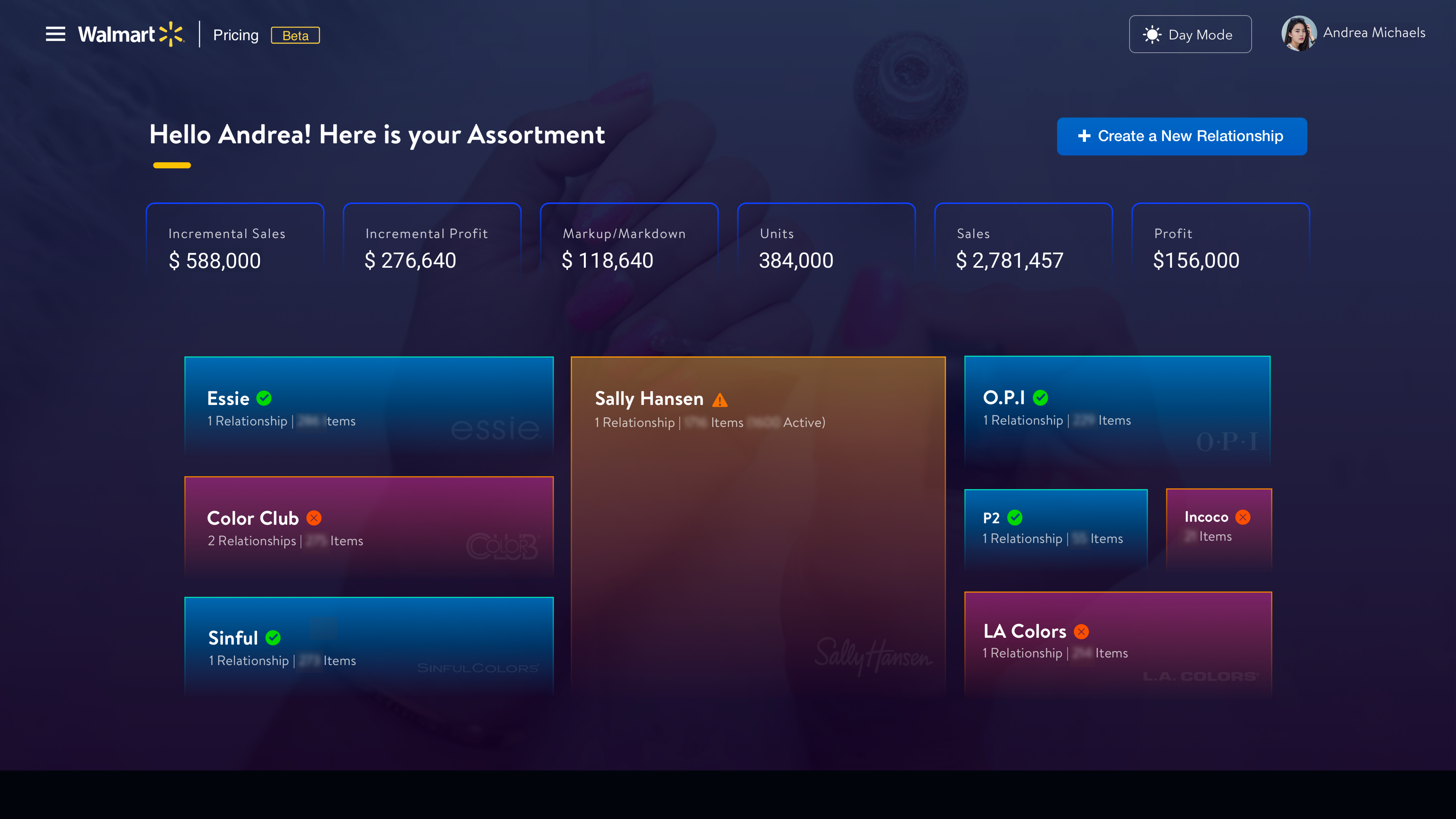

Solving a 6D problem in a 2D Interface

-

Project Type Summer Internship @Walmart

-

Platform Internal Web App

-

My Role UX Research and Design